"Oil prices had stabilized earlier

this month when the Organization of the Petroleum Exporting Countries

and Russia agreed to slash production by 1.2 million barrels a day. But

Russia announced on Monday that its output had increased to more than

11.4 million barrels a day, a record, putting in doubt its commitment to

coordinate policies with Saudi Arabia and other oil producers. On the

same day, the Energy Department reported that the United States was

producing 11.6 million barrels of crude oil a day, nearly a million

barrels more than a year ago. The department projects that shale-oil

production will climb to record levels this month, and increase by

134,000 barrels a day in January. A shortage of pipelines has

driven down oil prices from the Permian Basin of West Texas and New

Mexico, the most productive American oil field. But the completion of a

series of pipelines in late 2019 should benefit producers and increase

exports, adding even more barrels to the global glut."

Oil Prices Plummet 7% on Fears of a Glut

New York Times, 28 December 2018

"Total

oil production in the United States will be nearly equal to

that of Russia and Saudi Arabia combined by 2025, the head of the

International Energy Agency (IEA) said on Friday. Fatih Birol made the

comment in an interview with Turkey’s state-owned Anadolu news agency."

U.S. oil production to be equal to Russia plus Saudi Arabia by 2025: IEA head

Reuters, 21 December 2018

"The

collapse in oil prices, now hovering around $45 per barrel in the U.S.,

is terrifying, according to former Shell Oil President John Hofmeister.

“It’s getting to a scary point,” he said during an interview on FOX

Business’ Varney & Co. “If we get below $40 we’ll see rapid stopping of drilling because the companies simply can’t afford it.” The drop in oil is also a warning sign for the global economy. Viable prices, according to Hofmeister, range from $50 to $60 a barrel. Crude

prices sunk to a 17-month low on Friday, down about 24 percent this

year, as global oversupply kept buyers away from the market ahead of the

holiday break. However, in Hofmeister’s opinion, crude is at its lowest

point. “I hope for the sake of both consumers and the industry that we

are at the bottom,” he said. Currently national gas prices at the pump

average around $2.34 a gallon, as tracked by AAA. While consumers are getting a break, Hofmeister warned that cheaper prices could backfire.""

Oil prices are getting scary: Former Shell Oil president

Fox Business, 21 December 2018

"The biggest American oil field may be about to pump the brakes if crude keeps plunging. Just

10 weeks ago, the Permian Basin was on course to grow almost 1 million

barrels a day by the end of 2019, potentially surpassing Iraq, OPEC’s

second-largest producer. Now, it may not grow at all, removing a large

chunk of expected production from global oil markets. Shale is highly sensitive even to small changes in prices and

the Permian is not immune. With West Texas Intermediate oil at $70 a

barrel, the basin would likely produce 4.9 million barrels a day by end

of next year, but at $40, output will likely stagnate at around 4

million barrels a day, according to Oslo-based consultancy Rystad

Energy. As lower prices squeeze cash flows for oil explorers, investors will

pressure management teams to reduce 2019 drilling so as not to sacrifice

dividends or buybacks, Credit Suisse Group AG analysts led by William

Featherston said in a note on Wednesday. “The emerging investor demand

is to slow production growth,” the analysts said. It’s already starting to happen. Diamondback Energy Inc.,

one of the biggest Permian-only producers, is rowing back its 2019

capital budget, forecasting about $2.9 billion of spending, less than

analysts’ estimates of $3.2 billion. Chief Executive Officer Travis

Stice said the “dramatic decline in oil prices” were to blame as well as

higher service costs. Breakevens for new wells in various

counties that contain the Spraberry layer of oil-soaked rock in the

Permian currently average between $32 to $47 a barrel, according to Bloomberg NEF data.

But well performance varies substantially. In Upton County, for

example, top-quartile wells make money at $31 a barrel, while the bottom

quartile need $65.54 a barrel. “BNEF’s break-even model calculates that an average Permian

well can produce oil for under $50 a barrel, but only the top performers

in the Denver-Julesburg or Bakken can match that,” BNEF analyst Tai Liu

said Friday in a research note.... The Permian’s better productivity means output isn’t dropping, just

slowing down, if oil averages $50 a barrel and halting growth at $40,

Rystad said. IHS Markit and RS Energy, agree that modest growth is

likely at current prices because companies in the Permian have dropped

their well costs so much over the last four years through productivity

improvements. “There’s a lot less cash flow to go around but it’s

not an existential threat like it was in 2014,” said Ian Nieboer at RS

Energy, referring to the oil-price crash of that year. Higher-cost

production in the Bakken in North Dakota and Eagle Ford in south Texas

are more susceptible to the recent price plunge, he said. One of

the key advantages of shale is that crude flows from wells within weeks

of drilling, rather than years for large, offshore megaprojects that

defined the production growth in the early 2000s. That means shale can

be turned on or off like a tap, depending on whether it’s profitable or

unprofitable at any given price. That may be of no consolation to equity

investors starved of earnings, cash flow and dividends but it does help

to rebalance oil markets. “If we don’t get those barrels in 2019,

they will simply be waiting to show up in 2020, or 2021, or whenever

the market needs them,” said Raoul LeBlanc, a Houston-based analyst at

IHS Markit. “The eventual limit is sweet spot exhaustion, and in the

Permian, that will not happen in the next seven years.”"

Permian’s Growth Spurt at Risk of Being Stunted by Oil Collapse

Bloomberg, 19 December 2018

"Poland took another step towards weening itself off Russian energy

supplies on Wednesday by signing a 20-year agreement with San

Diego-based Sempra Energy to import U.S. liquefied natural gas. The signing marks the third long-term

contract the state-controlled Polish Oil and Gas Company, or PGNiG, has

inked with an American LNG company this year. In the coming years,

Warsaw plans to replace Russian gas with pipeline supplies from Norway

and shipments of LNG, or gas super-chilled to liquid from for transport

by sea.... Poland is preparing for a major shift in its energy imports after 2022,

when Warsaw says it will allow a contract with Russia's Gazprom to

expire. That plan also includes boosting imports from top LNG exporter

Qatar and building a pipeline link with Norway.... Duda is particularly opposed to the expansion of the Nord Stream

pipeline system that directly links Russia and Germany. Central and

Eastern European nations fear Moscow will use the new Nord Stream 2 line

to bypass existing infrastructure through Ukraine, making it easier for

the Kremlin to exert political pressure on its neighbors without

alienating Western Europe.... By 2023, Poland expects to be importing 7.45 million tons of LNG into

its Swinoujscie regasification terminal. Today, only six nations import

more LNG. Warsaw intends to export

some of that gas to 12 Central and Eastern European nations in the Three

Seas Initiative, which aims to bolster trade, infrastructure and energy

ties throughout the region. Beginning next year,

Gazprom's contracts with several European nations come up for contract,

according to a recent policy paper by Tatiana Mitrova and Tim Boersma

for the Columbia University's Center on Global Energy Policy. While only

Poland has signaled it will cut off Russian gas imports, the option to

buy U.S. LNG could loom large over the negotiations, the experts say."

Poland's goal of ditching Russian natural gas bolsters American LNG and Trump's energy agenda

CNBC, 19 December 2018

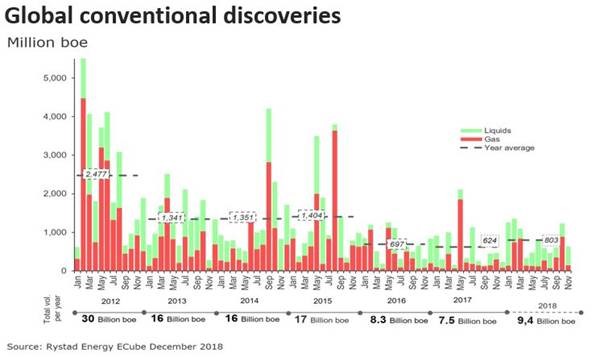

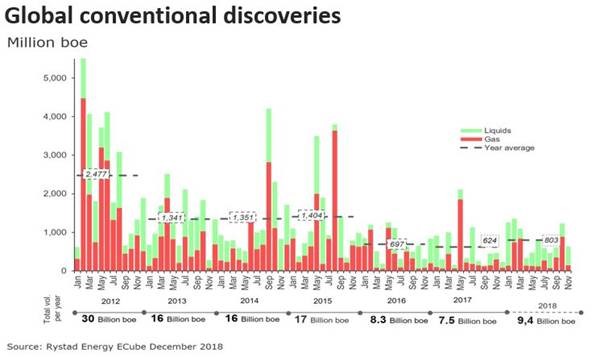

"2018 stands already as the best year for global oil and gas

exploration since 2015. Guyana, Russia and the United States top the

list with major discoveries. Discovered resources have already surpassed

8.8 billion barrels of

oil equivalent (boe) for 2018. Rystad Energy expects the number to grow

to 9.4 billion boe by year-end. “We at Rystad expect this discovery

trend to continue into 2019 with

many promising high-impact wells targeting vast potential,” says Palzor

Shenga, senior analyst on Rystad Energy’s Upstream team. Offshore

discoveries represent around 82% of total volumes. 2018 has

also seen a significant uptick in the reserve replacement ratio to

around 15% from 11% in 2017. “Global exploration activity and

discoveries have halted their

year-after-year decline and look set to rise in the next year. This as

an exciting recovery which runs contrary to a decline in global

exploration spending from 2014 to 2017,” Shenga adds. Exploration

spending decreased by nearly 61% from 2014 to 2018.

Exploration investments halted their fall in 2018 and are expected to

rise in 2019. “This not only proves that E&P companies are once

again willing

to invest in exploration, but also highlights their idea of ’smart

investments’ to de-risk expenditures as much as possible,” Shenga adds.

The decrease in overall exploration costs combined with an improved

success ratio have led to tremendous improvement in the discovery cost

per boe."

The oil & gas exploration winners of 2018

Rystad Energy, 17 December 2018

"In just over a year, the International Maritime

Organization based in London on the banks of the Thames will introduce

radical new guidelines forcing shippers around the world to stop using

dirty fuel oil and instead shift to low-sulphur marine diesel to help

clean up the environment. However, the impact of the change will

reverberate far beyond the world’s merchant fleets on the high seas...."

The world is sleepwalking into a $1 trillion energy nightmare

Telegraph, 14 December 2018

"A milestone was reached for renewable energy in November when more than

100% of Scotland’s electricity demand was met by wind turbines for the

first time – enough for nearly six million homes. Scottish weather is

powering a revolution. With ever-larger wind turbines being built at sea,

and wave and tidal power being developed, the problem will soon be how

to use this surplus energy. Some is already exported to England via

interconnector cables and in 2020 there will be another running from the

Aberdeen area to Norway. But this will not be enough and the race is on

to find ways to store cheap energy to sell back to the grid when demand

is high."

Weatherwatch: how do we store surplus renewable energy until we need it?

Guardian, 14 December 2018

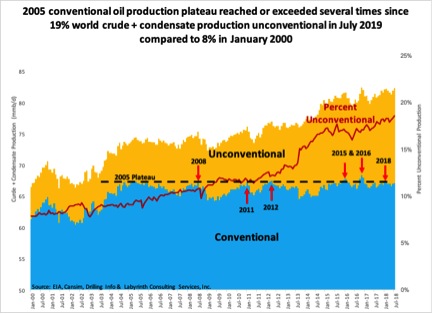

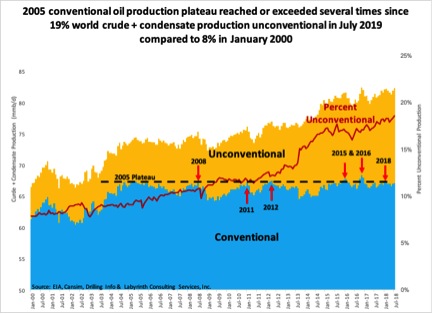

"The following graphic, prepared from US Energy Information

Administration data by Art Berman of Labyrinth Consulting, reveals the

plateau of conventional oil production since late 2004, and the growth

of so-called “unconventional” oil. Since 2000, as world traditional oil production stagnated, the amount of

“unconventional” oil has tripled, from five to 15 million barrels per

day."

Will peak oil save Earth’s climate?

Greenpeace, 14 December 2018

"The global oil market could move into deficit

sooner than expected thanks to Opec's output agreement with Russia and

to Canada's decision to cut supply, the International Energy Agency said

on Thursday. The Paris-based IEA kept its 2019 forecast for

global oil demand growth at 1.4 million barrels per day, unchanged from

its projection last month, and said it expected growth of 1.3 million

bpd this year. Uncertainty over the global economy stemming

from US-China trade tensions could undermine oil consumption next year,

as growth in supply gathers pace. "For 2019, our demand growth outlook remains

at 1.4 million bpd even though oil prices have fallen back considerably

since the early October peak," the IEA said."

Global oil supply to tighten quickly in 2019

Reuters, 14 December 2018

"U.S. liquids production

registered +3 mb/d in August according to the

EIA 914 report, and for oil bulls, U.S. liquids production in 2019 are

likely to eclipse +2 mb/d again... U.S. refineries are hitting a cap on

how much U.S. shale light oil it can take in considering that U.S.

refineries have a crude diet of API ~32....U.S.

shale is producing oil that's well above what the global

refineries are accustomed to run. Global refineries run an average API

gravity of 31.5 to 33, while most of the growth in U.S. shale production

is in API gravity 40-45..... If there was growing medium/heavy oil

production around the world, then global refineries may absorb the

excess U.S. shale light oil, but it's not...With

Canada now registering negative y-o-y growth in

2019 due to takeaway capacity issues, global medium/heavy oil production

will fall rather than climb. That's exactly the opposite of what's

needed here for an oil market that's increasingly showing a higher

appetite for medium/heavy oil. We also see this with end user demand in

gasoline vs diesel... In essence, the crude quality issue is likely to

exacerbate the shortage we see in the oil markets going forward."

U.S. Oil Production Likely To Grow 2 Mb/D In 2019 But Crude Quality Issue Will Get Worse

Seeking Alpha, 13 December 2018

"U.S. crude oil output growth was expected to slow slightly for this

year compared with previous forecasts, the Energy Information

Administration said on Tuesday, but at a record 10.88 million barrels

per day, the nation will end 2018 as the world’s top producer. Output

this year was forecast to rise 1.53 million bpd to 10.88 million bpd,

down from the EIA’s previous estimate of an increase of 1.55 million

bpd. The current all-time U.S. annual output peak was in 1970 at 9.6

million bpd, according to federal energy data. For 2019, U.S.

crude oil production was expected to average 12.06 million bpd, the EIA

said, up 1.18 million bpd from the prior year which is a small upward

revision from the previous forecast of a 1.16-million bpd rise. A

shale revolution has helped the United States produce a record amount

of oil this year and topple Russia and Saudi Arabia as the world’s

biggest producer.... In 2019, oil demand is estimated to rise by 330,000 bpd to 20.81

million bpd, up from its previous estimate of a rise of 220,000 bpd. For

2018, U.S. oil demand is expected to rise by 520,000 bpd to 20.48

million bpd, EIA said, slightly raising its previous forecast of a

510,000 bpd rise to 20.47 million bpd."

U.S. expected to end 2018 as world's top oil producer: EIA

Reuters, 11 December 2018

"Alberta’s oil-production curtailment plan has largely accomplished its mission -- even before it has gone into effect. Since

Canada’s top oil-producing province announced mandatory output curbs on

Dec. 2, the spot price of Western Canada Select crude has surged more

than 70 percent. The grade’s discount to the U.S. benchmark has been

chopped in half to around $13 a barrel, the narrowest in more than a

year. Other blends, including Edmonton Mixed Sweet and Syncrude, also

are surging. Oil producers are saying the 8-day-old plan will bring “significant relief”

to the province’s pipeline congestion problem, and it’s even being

credited with preventing layoffs for at least one major oil-sands

company. The 325,000-barrel-a-day supply cut takes effect next month."

Planned Production Cuts Are Already Easing Alberta’s Oil Crisis

Bloomberg, 10 December 2018

"...the week of November 30 through December 5 saw the United States of

America actually export more crude oil and other oil-derived liquids

than it imported from other countries. The key part of that sentence is

"other oil-derived liquids," which include gasoline, diesel and other

refined products. Rolling all of those products into the equation, the

U.S. exported about 211,000 barrels per day more than it imported for

the week, as reported by Bloomberg. The U.S. did not become a net exporter of "crude oil," as some others in the energy news media mistakenly reported. As Robert Rapier reported at

Forbes.com over the weekend, our country is still a sizable net

importer of crude alone, an equation that will not be reversed anytime

soon.... Regardless, the fact that the U.S. had higher volumes of oil-derived

liquids moving out of its various ports than it had coming for a full

week is an extraordinary change of circumstance from just a decade ago, a

true sea change delivered by the ability to extract oil from the

nation's shale formations.... The U.S. Energy Information Adminstration (EIA) reported on November 29

that the country's proved reserves of both oil and natural gas reached

all-time record highs in 2017. As the report notes,

reported reserves levels surpassed previous highs recorded in 2014 for

natural gas and in 1970 for crude oil: 'Proved reserves of U.S. crude

oil increased 19.5% from the end of

2016, reaching 39.2 billion barrels and surpassing the previous peak

level of 39.0 billion barrels set in 1970. Proved reserves of natural

gas increased 36.1% from the end of 2016 to reach 464.3 trillion cubic

feet (Tcf) in 2017, surpassing the previous record of 388.8 Tcf set in

2014.' Again, this is all due to the Shale Revolution, enabled by the

wedding

of hydraulic fracturing with horizontal drilling. The 1970 date of the

previous high for U.S. crude oil reserves is notable because it was the

year that "Peak Oil" theorist M. King Hubbert predicted

that global crude oil production would reach its "peak" in the 1956

paper he presented to an API conference in San Antonio. Hubbert got that

part of it kind of right, though he never envisioned that the industry

would ultimately find a way to extract oil from shale and shatter all of

the oil production records all over again.... the U.S. Geological Survey (USGS) released an update to its previous

estimates of the resource potential for the Wolfcamp Shale last week,

and the volumes contained in the report, which

assesses not just the Wolfcamp Shale itself, but also the conventional

Bone Springs formation directly above it, are stunning to say the least:

* 46.3 Billion barrels of crude oil; * 20 Billion barrels of natural

gas liquids; and *

281 Trillion cubic feet of natural gas." These numbers are almost

incomprehensible to most people, so it helps to try to place them into

some context: *The most prolific oil resource ever discovered in North

America is

the Prudhoe Bay field on the North Slope of Alaska. Over the last

40+

years, Prudhoe Bay has produced about 14 billion barrels of crude

oil.

USGS projects that the Wolfcamp will produce 3.3 times that volume over

its life.* That 46.3 billion barrels of crude oil represents about 6.5

years of total U.S. consumption. * 281 Trillion cubic feet of natural

gas represents 12 years of total U.S. consumption. * Put another way,

this is enough natural gas to supply all of our nation’s gas-fired power plants for about 35 years. * 20 billion barrels of natural gas liquids represents

roughly 21 years of total U.S. consumption.... All of that gas in

place will be produced as "associated gas" coming

from wells classified as "oil" wells by regulators in Texas and New

Mexico.... As a reminder, the USGS estimates

are compiled using the most

conservative means possible. They are derived from the "proved reserves"

reported by companies to the SEC, and focus on "technically

recoverable" resource, which means volumes that can be recovered using

currently-available technology. Technology advances in the oil and gas

industry each and every day, and as we have clearly seen over the last

three years, the pace of advancement is only accelerating over time. So,

as enormous and near-incomprehensible as those numbers are, it is

important to remember that they are in fact a fraction of what the

ultimate recoveries will turn out to be."

The Oil And Gas Situation: A Time For Setting Records

Forbes, 10 December 2018

"...some scientists think a prolonged dip in solar activity known as the Maunder Minimum,

which occurred from about 1645 though 1715, helped intensify the Little

Ice Age. The Little Ice Age — which subjected Europe and North America

to much colder winters than the ones we currently experience — lasted

from about 1300 through the mid-19th century, so the Maunder Minimum

sits right in the middle of it chronologically. The potential association between these two events is debated, however;

researchers still don't know for sure exactly what caused the Little

Ice Age. Solar activity has been trending downward over the last few cycles, and

the most recent one, known as Solar Cycle 24, has been the weakest in

more than a century. This has sparked some speculation that we could be headed toward another Maunder-like dip

— and, perhaps, a bit of a reprieve from some of the worst effects of

global warming. But this scenario likely won't come to pass, at least

not over the next

decade or so, according to the new study, which was published Thursday

(Dec. 6) in the journal Nature Communications.

Researchers Prantika Bhowmik and Dibyendu Nandi — both based at the

Indian Institute of Science Education and Research Kolkata — came up

with a new way to simulate solar activity over century-long timescales.

Their approach incorporates magnetic-field evolution models of both the

sun's surface and interior. The duo's simulations match up very well

with actual solar activity

over the past 100 years, as measured by sunspot counts. And they make

predictions about the coming Solar Cycle 25. Bhowmik and Nandi's work

suggests that the new cycle will begin about a

year from now and peak in 2024. The simulations also indicate that the

solar-activity slide will stop, at least for a spell: Solar Cycle 25

should be of similar or of greater intensity than Solar Cycle 24. "The

behavior of the magnetic field and the particles emitted from the

sun has a profound effect on the Earth's climate and living conditions

of the Earth's inhabitants, as well as various other activities that

involve long-range communication and satellite technology," Somak

Raychaudhury, director of the Inter-University Centre for Astronomy and

Astrophysics in Pune, India, said in a statement. "Normally, we assume that these effects are too complex for us to

predict and restrict ourselves to reacting to these phenomena as best we

can," added Raychaudhury, who was not involved in the new study.

"Bhowmik and Nandy's models show considerable predictive power, and it

looks like we will now be able to predict the fluctuations of solar

activity much more reliably.""

No Global Cooling Miracle: Sun's Activity Lull Will Stop Soon, Study Suggests

Space.com, 7 December 2018

"The

Permian Basin's Wolfcamp and Bone Spring

formations in West Texas and New Mexico hold the most potential oil and

gas resources ever assessed, the U.S. Interior Department said Thursday.

The

region in the Permian's western Delaware Basin holds more than twice as

much oil as the largest previous assessment - the Wolfcamp shale in the

Permian's separate Midland Basin southeast of Midland. That study was

completed two years ago. To

put the new results into perspective, the Delaware Basin's Wolfcamp and

Bone Spring plays would hold almost seven times as much oil as North

Dakota's Bakken shale.The Wolfcamp shale and overlying Bone Spring in

the Permian's booming

Delaware Basin hold an estimate 46.3 billion barrels of oil, 281

trillion cubic feet of natural gas, and 20 billion barrels of natural

gas liquids, according to the U.S. Geological Survey's new

assessment.... Much of the new activity in the Permian is in the

Delaware's Wolfcamp in Loving, Winkler, Reeves, Culberson and Ward

counties on the Texas side, and primarily Eddy and Lea counties in New

Mexico. The

U.S. is producing record volumes of oil and gas, and nearly one-third

of the nation's total crude oil volumes are coming from the Permian.

Those amounts are continuing to grow. An

older basin, the Permian has become the center of the oil and gas world

in recent years through the combination of horizontal drilling

techniques and modern hydraulic fracturing, or fracking, technologies.

The study is based on undiscovered oil and gas that's considered

technically recoverable based on these modern extraction methods. That's

different from the proven reserves that oil companies list on their

budgets after they drill exploratory wells and study the reservoirs."

USGS: Permian's Wolfcamp is largest potential oil and gas resource ever assessed

Houston Chronicle, 6 December 2018

"Germany will not withdraw its political support for the Nord Stream 2

gas pipeline with Russia, its foreign minister said on Monday, as some

lawmakers suggested curtailing the project to punish Moscow for its

seizure of Ukrainian ships and their crew. Russia is resisting international calls to release three Ukrainian

ships seized last month in the Kerch Strait, which controls access to

the Sea of Azov near the Crimea region that Moscow annexed from Ukraine

in 2014. Moscow accuses the 24 sailors of illegally entering

Russian waters by trying to pass through the strait. Kiev says the

sailors did nothing wrong, and its ships have the right to pass through

the strait to reach Ukrainian ports in the Sea of Azov."

Germany to back Russian gas link despite Ukraine tensions

Reuters, 3 December 2018

"Israel has set targets for greater use

of gas in power generation and transport over the coming decade

Israel's top energy official has confirmed that the

government is committed to natural gas becoming the primary source of

energy in the years ahead. Energy minister Yuval Steinitz told an

international energy and

business convention in Tel Aviv on 19 November that the use of coal will

end by 2030, with a power-generation fuel basket based on 83pc gas and

17pc renewables taking its place. This represents a major shift from

current levels—in 2017 power generation comprised 64.1pc

gas, 32.5pc coal and 3.5pc renewables. The transportation sector, the

minister added, would run entirely on

gas. By 2030, compressed natural gas (CNG) will fuel heavy duty trucks

and electric cars will use energy generated by natural gas. Ron Adam,

the special envoy for energy at the Israeli foreign affairs

ministry and Yossi Abu, the CEO of Delek Drilling, each provided

updates on various aspects of gas export projects that are underway. Abu

noted that exports to Jordan's NEPCO will commence as soon as the

vast offshore Leviathan field is operational in Q4 2019. Construction

of an Israeli gas transmission system in the north to the border with

Jordan is due to be completed by May 2019, while Jordan is progressing

at a similar pace with its own north-to-south grid. He added that

exports to a private company in Egypt, albeit at

relatively small quantities at first from the Tamar field, will start

around the same time, via the 89km (55-mile) East Mediterranean Gas

(EMG) pipeline that connects Ashkelon in Israel to el-Arish in Egypt.

Export volumes to Egypt will increase gradually once Leviathan comes

on line and after the final export routes have been decided. These

routes could include one or more options to export up to 7bn cm/y of

Israeli gas to Egypt. Firstly, the parties could use the Israeli

transmission system to

export via the EMG line; circumvent the Israeli system (and thus avoid

the transmission tariff and the congested lines in the south of Israel)

by hot-tapping from the Tamar and/or Leviathan offshore lines for a

direct connection to EMG. There is also the option of using the Israeli

transmission system in

the north to export via the Jordanian grid and into the Pan-Arab

pipeline via Aqaba in Jordan and up to el-Arish in Egypt. Finally, there

is potential to connect the Israeli Leviathan field

together with the Cypriot Aphrodite field, via a direct 400km offshore

pipeline to be constructed directly to the Idku LNG export facilities.

Another export option, discussed by energy envoy Adam, was one that

is being promoted by IGI Poseidon, a 50-50pc joint venture between Depa

and Edison that is about to commence a detailed FEED study at a

cost of

€70mn ($79mn), to look at the technical and commercial feasibility of

exporting Israeli and Cypriot gas to the one global market where imports

are increasing steadily, the EU."

Israel plans to be powered by natural gas

Petroleum Economist, 30 November 2018

"Thousands of electric vehicles are to be hooked up to Britain's

electricity grid to test its ability to cope with power fluctuations

caused by a mass roll-out of the technology. The trial of 3,000 of the vehicles in London and the South of England

has been approved by Ofgem, Britain's energy regulator, and is being

led by Uber and Centrica, the owner of British Gas. The cars will be on the road by the second half of next year and the

trial will continue until 2022. data will be collected about

the

distance traveled, the cost of trips, as well as the amount of energy

consumed and the times of day at which vehicles were charged. The data

and results that Uber and Centrica collect from the trial will be shared

openly, the companies said. Utility companies are keen to understand

how the grid will cope in

the event of large-scale adoption of electric cars, especially the

additional demand for power they will create at specific times of day,

such as when owners return from work and seek to charge them up

overnight. The trial area, which will cover roads from Basingstoke to

Dover, was chosen as it will be the part of the country that will adopt EVs the fastest in the future, according to UK Power Networks, one of the project's partners."

Centrica, Uber launch electric vehicle trial to monitor impact on UK energy grid

Telegraph, 30 November 2018

"Storm Diana brought travel chaos to road, rail and airports, but the

clouds did have a silver lining: the strong winds helped set a renewable

energy record. Windfarms supplied about a third of the UK’s electricity between 6pm

and 6.30pm on Wednesday, a time of peak energy demand. Output hit a high

of 14.9GW, beating a previous record of 14.5GW. The milestone coincides with the official opening on Friday of E.ON’s

Rampion windfarm off the coast near Brighton, which is the first in the

Channel and can power about 350,000 homes. Blustery weather has buoyed wind output in the past few days, with

National Grid reporting thousands of wind turbines were the UK’s No 1

source of power across Wednesday and Thursday, at about 32% of

generation. Gas power stations are usually top. Windfarms have moved from a niche source of electricity generation a

decade ago – when they supplied less than 2% – to a cornerstone of

Britain’s power mix, at nearly 15% of supply last year. The 400MW Rampion project is one of four big offshore windfarms to

come online this year, along with a 92MW windfarm in Aberdeen Bay, a

353MW windfarm off the Suffolk coast and a 659MW windfarm off Cumbria, which is the world’s biggest. More vast schemes are in the wings, with a 588MW windfarm in the

Moray Firth due to become fully operational next year. The title of

world’s largest windfarm will be taken by a 1,218MW project off east

Yorkshire a year later. Emma Pinchbeck, the executive director of the industry body

RenewableUK, said: “It’s great to see British wind power setting new

records at one of the coldest, darkest, wettest times of the year.”"

Windy weather carries Britain to renewable energy record

Guardian, 30 November 2018

"The return of oil flows

from the disputed region of Kirkuk in Iraq is a welcome sign of

improvement in the relations between the Kurdistan Regional Government

(KRG) and the Iraqi government. Recent geopolitical developments in the

region looks to be slowly bringing the two sides closer together. Historically

fraught relations between the two sides, which have seen decades of

disputes, came to a head last year when the Iraqi Kurds held an

independence referendum. This resulted in the Iraqi government taking

control over the disputed region of Kirkuk and its surrounding oilfields

in retaliation. But after almost a year of negotiations Iraqi

officials have announced that an agreement has been reached to export

Kirkuk crude through the Kurd’s pipeline, the only conduit to

international markets. The

breakthrough primarily came as a the result of an intervention by the

Trump administration in the US, which is keen to make up for the fall of

oil exports from Iran after placing sanctions on their oil industry. The

US has recently mounted pressure on Baghdad to restart crude export

from Kirkuk to the Ceyhan port in Turkey. US State Department

spokeswoman Heather Nauert stated on November 16 that the resumption of

exports of Kirkuk oil was “another important step in our efforts to

reduce Iran’s oil exports.” Earlier this month, the Trump

administration granted Iraq a special waiver of 45-days for purchasing

Iranian electricity imports. But the waiver came with conditions; Iraq

cannot use US dollars for Iranian imports and must resume crude exports

from Kirkuk working in co-ordination with the Kurds. US President Donald

Trump has on several occasions stated that he wants to see lower oil

prices. His administration has already convinced Saudi Arabia to

increase production and it looks like similar efforts have taken place

in Iraq. The Kurds and the central government have previously

struck agreements regarding the use of the Kurdish pipeline but

budgetary and revenue disputes, as well as a Kurdish independence

referendum, have led to the deals quickly breaking down.... Another reason for the US to exert more pressure on KRG and Baghdad

is Russia’s increasing presence in the country. Last year, the KRG

struck a deal with Russian oil company Rosneft buying 60 per cent of the

Kurdish-controlled pipeline. It is not clear how exactly how the deal

will be stipulated or if Rosneft will have a say in this, but early

reports suggest that Iraq will allocate a portion of the 2019 Iraqi

budget to the KRG in return for use of the pipeline. Meanwhile,

the KRG can continue exporting crude independently from fields under its

control in Iraqi Kurdistan. Should the deal hold with exports from

Kirkuk increasing, the market will see additional oil flows helping to

keep the pressure on oil prices and, in turn, Iran."

Oil flows again from Iraq’s Kirkuk thanks to US intervention

Financial Times, 30 November 2018

"Faced with a rapidly deteriorating economic outlook for her province,

Alberta Premier Rachel Notley took her most dramatic action yet on

Wednesday with the announcement that her government will buy two trains

to move oil out of the province. “We have already engaged a third-party to negotiate and work is well

under way. We anticipate conclusion of the deal within weeks,” Notley

said during a speech to business executives in Ottawa. The

decision comes as the province’s economic picture has worsened

dramatically over the past six weeks amid discounts on Canadian oil that

recently hit a record US$50 per barrel....The trains would carry capital costs of approximately $350 million and

allow the government to move an additional 120,000 barrels of oil per

day out of the province by late 2019, which the premier expects would

generate $1 million per day in new federal revenues and narrow the

discount for Canadian oil by $4 per barrel."

Fiscal and economic insanity': Notley compelled to buy trains to get Alberta oil to market

Vancover Sun, 29 November 2018

"The United States has surpassed the 1970 record for proven oil and

gas reserves, roughly doubling the amount of discovered petroleum in the

ground in the past decade, the federal government said Thursday. The U.S. shale boom has unlocked large

volumes of oil and gas, currently driven by drilling for crude oil in

West Texas' booming Permian Basin and for natural gas in the Marcellus

and Utica plays in Pennsylvania and neighboring states. Proven reserves of crude oil in the U.S. jumped almost 20 percent to

39.2 billion barrels by the end of 2017, setting a record. The previous

record, in 1970, was 39.0 billion barrels. The U.S. is churning out a

record of 11.7 million barrels of crude a day, the Energy Department

estimates. Likewise, natural gas reserves jumped 36 percent to 464.3 trillion

cubic feet, a record that surpassed the previous mark set in 2014.

Record-high natural gas production also spiked 4 percent from 2016 to

2017. Since the 1970s, the nation's petroleum

reserves had been in decline for roughly three decades. The shale boom

changed that more than a decade ago when companies began combining

horizontal drilling techniques with hydraulic fracturing, called

fracking, to unlock the oil and gas from the tight shale rock."

U.S. oil and gas reserves surpass 1970 record

Houston Chronicle, 29 November 2018

"Renewable energy sources (i.e., biomass, geothermal, hydropower,

solar, wind) accounted for nearly 18% of net domestic electrical

generation during the first three-quarters of 2018, according to a SUN

DAY Campaign analysis of just-released data from the U.S. Energy

Information Administration (EIA). In addition, the latest issue of EIA’s “Electric Power Monthly” (with

data through September 30, 2018) reveals that solar and wind both

showed strong growth with utility-scale solar expanding by 30.3%* and

wind by 14.5% compared to the first nine months of 2017. Combined, wind

and solar accounted for almost 9% of the nation’s electrical generation

(wind – 6.4%, solar – 2.4%) and nearly half (49.7%) of the total from

all renewable energy sources. Modest increases were also reported by EIA for geothermal and

biomass—5.4% and 1.5% respectively. Taken together, non-hydro

renewables, including distributed solar, grew by 14.9%. However, a 5.1%

drop in hydropower output netted an increase of only 6.0% in electrical

generation by all renewables in the first three-quarters of 2018

compared to the same period in 2017. Notwithstanding its lower production, hydropower remained the leading

source of renewable electricity—accounting for 7.05% of total

electrical generation, followed by wind (6.41%), solar (2.42%), biomass

(1.48%) and geothermal (0.39%). The decline in hydropower coupled with a 4.9% increase in total

electricity produced by all sources (driven primarily by a 15.1%

expansion of electrical production by natural gas and a 2.2% increase in

nuclear power) resulted in renewables increasing their share of

domestic electrical output only marginally—from 17.6% in 2017 to 17.8%

in 2018."

U.S. solar generation up by over 30% in first three-quarters of 2018

Solar Power World, 29 November 2018

"Buried below the seabed around Japan, there are beds of methane, trapped

in molecular cages of ice. In some places, the sediment covering these

deposits of frozen water and methane has been eroded away, leaving

whitish mounts of what looks like dirty ice rearing up out of the

seafloor. There’s no doubt that methane hydrates could offer a major source of

fuel, with recent estimates suggesting they constitute about a third of the total carbon

held in other fossil fuels such as oil, gas and coal. Several nations,

notably Japan, want to extract it. It is not hard to find, often leaving

a characteristic seismic signature that can be detected by research

vessels. The problem is retrieving that gas and bringing it to the

surface. It all comes down to physics. Methane hydrates are

simply too

sensitive to pressure and temperature to simply dig up and haul to land.

They form at typically several hundred metres beneath the seafloor at

water depths of about 500 metres, where pressures are much higher than

at the surface, and temperatures are close to 0C. Take them out of these

conditions, and they begin to break down before the methane can be

harnessed. But there are other ways to do it. “Instead, you have

to force those deposits to release the methane from the formation in the

seafloor. Then you can extract the gas that comes off,” says Ruppel....

Given the difficulty of retrieving gas from methane hydrate reserves,

and the concerns around extraction, the stakes have to be high for a

nation to invest heavily in this technology. Having very few other

options in terms of domestic energy makes this hard-to-access source of

methane an appealing prospect. Japan is not a country that has other

carbon-based sources of energy to fall back on....methane hydrates – if

they are to play a role in Japan’s energy future –

are likely to be used as a bridging fuel, in the transition towards

renewables. Natural gas is the least carbon-intensive form of fossil

fuel, releasing less carbon dioxide per unit of energy released than

coal or oil. But, as a carbon-based fuel, burning it still contributes

to climate change.... How useful a role it can play in the future

depends on how quickly

methane hydrate can be accessed and produced on a commercial scale. The

Japanese government hopes to begin commercial projects exploring methane

hydrate between 2023 and 2027, according to its latest Strategic Energy Plan. This

target could be a bit ambitious. Jun Matsushima, a researcher at the

Frontier Research Center for Energy and Resources at the University of

Tokyo, puts the estimate at around 2030 to 2050."

Why 'flamable' ice could be the future of energy

BBC, 28 November 2018

"ENGINEERS have called on the UK government to immediately spend £125m

(US$159m) designing a hydrogen production, distribution and storage

system that would create the world’s largest CO2 reduction project. If realised it would decarbonise 14% of UK heat by 2034, and all told cost £22.7bn. The H21 North of England plan was presented at the

Institution of Mechanical Engineers in London on Friday by UK gas

network operators Cadent and Northern Gas Networks, and Norwegian state

energy giant and CCS expert Equinor. It’s a more ambitious update to the

H21 Leeds City Gate project published in 2016 that established how to

convert UK gas networks to carry hydrogen. The partners suggest the UK builds a 12.15 GW natural-gas-based

hydrogen production facility that would feed hydrogen, in place of

natural gas, through the existing gas distribution network to industry

and domestic users across the North of England. This would include

converting some 3.7m meter points in Teesside, Newcastle, York, Hull,

Leeds, Bradford, Halifax, Huddersfield, Wakefield, Manchester and

Liverpool, representing some 17% of domestic gas connections. .... After studying national energy requirements and proven production

technologies, the team has recommended the UK reforms natural gas into

hydrogen using autothermal reforming technology coupled with carbon

capture and storage to bury up to 20m t/y of CO2 offshore in

the North Sea. The £8.5bn production plant would be sited either in

Easington or Teesside on the east coast of England, where natural gas

from the North Sea is already brought ashore and processed, and would

consist of nine 1.3 GW autothermal reformer units operating in parallel."

Engineers publish £22bn blueprint for UK to take global lead on hydrogen heating

The Chemical Engineer, 27 November 2018

"President

Emmanuel Macron said on Tuesday that

France would shut down 14 of the country's 58 nuclear reactors currently

in operation by 2035, of which between four and six will be closed by

2030. The total includes the previously announced shutdown of France's

two

oldest reactors in Fessenheim, eastern France, which Macron said

was now

set for summer 2020. He also announced that France would close its

remaining four

coal-fired power plants by 2022 as part of the country's

anti-pollution

efforts. In a speech laying out the country's energy policies for the

coming

years, Macron said that "reducing the role of nuclear energy does

not

mean renouncing it". France relies on nuclear power for nearly 72

percent of its

electricity needs, though the government wants to reduce this to 50

percent by 2030 or 2035 by developing more renewable energy

sources. Macron said France would aim to triple its wind power

electricity

output by 2030, and increase solar energy output fivefold in that

period. He added that he would ask French electricity giant EDF to study

the feasibility of more next-generation EPR nuclear reactors, but

will

wait until 2021 before deciding whether to proceed with construction.

EDF has been building the first EPR reactor at Flamanville along

the Atlantic coast of northwest France -- originally set to go

online in

2012 -- but the project has been plagued by technical problems and

budget overruns."

France to close 14 nuclear reactors by 2035 an all coal-fired power plants by 2022

AFP, 27 November 2018

"U.S. shale firms are more profitable than ever after a strong third

quarter, according to a Reuters analysis of results for 32 independent

producers. These companies are producing more efficiently, generating

more cash flow and consolidating in a wave of mergers, the data show. Results

at 32 independent shale explorers show nearly a third generated more

cash from operations than they spent on drilling and shareholder

payouts, a group including Devon Energy, EOG Resources and Continental

Resources. A year ago, there were just three companies on that list. The

group’s cash flow deficit has narrowed to $945 million as U.S.

benchmark crude hit $70 a barrel and production soared. The group

overspent by three times as much as recently as June and was $4.92

billion in the hole a year ago, according to Reuters’ analysis of

Morningstar data provided by the Institute for Energy Economics and

Financial Analysis. The change is evidence shale firms

have moved to “harvest mode” after shareholders pressured them to rein

in spending and increase payouts, said Shawn Reynolds, a portfolio

manager at asset firm VanEck. “The industry is starting to do that.”"

Drax power station storing CO2 gases from biomass fuel

BBC, 26 November 2018 "The

biggest power station in the UK

has started a project to store carbon dioxide emissions and the gas

could be used in the drinks industry. In May, Drax power station

near Selby, North Yorkshire, announced a £400,000 pilot scheme to

capture the gas produced from burning wood pellets. Drax officials say

the scheme would see about a tonne of gas stored each day."

Drax power station storing CO2 gases from biomass fuel

BBC, 26 November 2018

"Consumers are being forced to pay higher energy bills thanks to the

cost of installing smart meters – and things could still get worse,

according to the spending watchdog. An investigation by the National Audit Office (NAO)

into the £11bn roll-out of the meters has suggested that energy bills

could rise by more than £500m in total. It criticised the Government for

allowing so many first-generation meters, which can “go dumb” after a switch of supplier, to be installed. The costs of the roll-out are being added to energy bills and work

out at around £374 per dual-fuel household. While there are said to be

long-term benefits of having a smart meter, with the annual saving

estimated at £18 a year by 2030, the NAO said the roll-out had had a

negative impact on consumers’ bills so far."

Smart meters ‘to add £500m to energy bills’

Telegraph, 25 November 2018

"China is holding out the prospect of joint oil and gas development in

disputed areas of the South China Sea as an inducement to its

politically weaker south-east Asian neighbours, as it seeks to close off

the waters to outsiders. Beijing has until now used its

internationally unrecognised “Nine-Dash Line” claim to exercise a de

facto veto on other countries’ attempts to exploit the rich mineral

reserves within the disputed waters. However, in visits to Brunei and the Philippines

this week, Chinese president Xi Jinping presided over the signing of

memoranda of understanding for joint oil and gas exploration and

development with the two countries, promising to share the costs. Critics

in the region were quick to condemn China’s offer on energy, a core

economic issue at the heart of the multiple territorial disputes in the

region. They warned it risked creating new legal facts on the ground as

tangible and permanent as the artificial islands and airstrips China is building in the sea. “Signing

the Chinese draft will make the Philippines recognise an unlawful

‘co-ownership’ with China of the West Philippine Sea,” two political

opponents of the pro-Beijing president Rodrigo Duterte said in a resolution opposing the MoU as unconstitutional, and pressing the government to release a draft."

"India is working to establish a natural gas trading exchange, its

Prime Minister Narendra Modi said on Thursday, as part of a shift away

from a reliance on crude oil based products which are blamed for much of

the country's pollution problem. "We want to increase the use of natural gas by 2.5 times by the end

of next decade," Mr Modi said in New Delhi at the laying of a foundation

stone for the setting up of city gas distribution (CGD) networks in 129

districts which have been auctioned. India wants to develop a transparent market for natural gas where the

price is determined on an exchange and aims to increase the use of

natural gas in India's total energy mix from 6.5 per cent to 15 per cent

between 2028 and 2030."

India's Modi targets gas exchange to ease shift from oil

Business Times, 22 November 2018

"In the complicated world of devolved responsibilities, environmental

protection was one of the clearest areas in which law and

decision-making was given from Westminster to the devolved parliaments

and assemblies. In the quest to go green, Scotland is way ahead of the

rest of the UK, with nearly all electricity produced by wind power. In

October, 98% of Scotland's electricity was produced by wind turbines,

with the devolved government on track to produce all of its electricity

from renewable sources by 2020. One area of Scotland which is at the

forefront of renewable energy is

Orkney, where they generate more electricity from wind turbines than

they can use, and also have the world's leading testing facility for

emerging wave and tidal power systems. While the owners of wind turbines

can sell excess electricity back to

the National Grid, Orkney with its 750 domestic wind turbines and

several larger ones owned by community energy cooperatives, has come up

with a different idea: using the electricity to split water (two

resources they have plenty of) to produce hydrogen and oxygen with the

help of a hydrogen electrolyser. As Neil Kermode of the European Marine

Energy Centre explains, the uses

of hydrogen are many: "Once you've got hydrogen you can either turn it

back to electricity somewhere else, or there's the ability to store it

and transfer the power, or you can use it for heating and burn it, or

you can put it in cars for hydrogen fuel cell cars." In Orkney, they're

attempting to put their hydrogen to several of these uses. Currently

they are using hydrogen to power the fuel cells on the

ferries which sail between the islands, providing the vessels with all

the energy for their auxiliary powers such as lighting, refrigeration

and heating, but the islanders are not stopping there. Their ultimate

goal is to replace the diesel ferries with a new generation powered by

hydrogen charged fuel cells.

"

Why Scotland is leading the way in renewable energy and what we can learn from it

ITV, 22 November 2018

"Millions of gas boilers will need to be replaced with hydrogen

alternatives and coupled with electric heating devices if Britain is to

hit its carbon targets at the lowest cost, according to the government’s

climate advisers. In a report on the role hydrogen could play in the energy system, the

Committee on Climate Change (CCC) spelt out the huge but necessary cost

the country faces to switch to green heating. The cheapest scenario, it said, is a mix of electrifying heating and

fitting hydrogen boilers, and will cost the UK £28bn a year, or 0.7% of

GDP, by 2050. While electricity supplies are rapidly switching to low-carbon sources,

almost all homes today rely on fossil fuels – predominantly natural gas

– for heating and cooking. The public is largely unaware of the

alternatives, said the report,

and consumer understanding is “far from where it would need to be”

before decisions on decarbonising heating are made in the 2020s. While

householders can keep their radiators, the CCC envisages that

in future they will need to live in much more energy efficient homes

with heat pumps that use electricity to draw heat from the ground or

air, running alongside gas boilers. Air-source heat pumps cost about

£6,000-£7,000 but are expected to become cheaper as they become more

mainstream. To meet the long-term goal of cutting carbon emissions 80%

by 2050,

gas boilers would eventually need to be replaced by hydrogen ones that

provide backup heating at times. Chris Stark, the chief executive of the

CCC, said the committee had

previously been a “bit suspicious” of heat pumps but was now confident

enough to recommend their rollout as a hybrid heating measure running

alongside gas boilers, before a later move to hydrogen too. “I’ve been

cautious about the hydrogen story, because it’s often

portrayed as a panacea. [But] I’ve been surprised how well it’s come out

of our modelling when it’s accompanied by energy efficiency and

electrification from heat pumps,” he said. Stark urged the government to

set out its plan for decarbonising heat in the next three years. The

report said while ministers may have “a strong temptation

politically to ‘kick the can down the road’ by sticking with natural gas

for longer”, it would be cheaper and better to act sooner. Despite the

high costs of decarbonising heating, the CCC believes the

total consumers spend on energy bills could stay similar to today, as

it expects electricity prices to fall as more is sourced from wind,

solar and nuclear, and costs of running a car to become cheaper owing to

the switch to electric vehicles."

UK advised to look at hydrogen heating to hit 2050 emissions targets

Guardian, 22 November 2018

"Dr. Robert Trice, a lifelong rock obsessive who’s also chief executive

officer of independent oil company Hurricane Energy Plc, adjusts his

glasses and shakes his mop of pale hair. Then he explains his

billion-dollar idea.... From inside a ship, sloshing around the 65-foot waves off the coast

of the Scottish isles, he plans to poke a diamond-tipped drill-bit into

the sea bed. He’ll take it past layers of once-oil-soaked sandstone

rocks straight into a strata of solid granite -- what geologists call

the basement. Then the drill will turn sideways and hopefully intersect a

bunch of naturally formed cracks. If his science is correct, there will

be enough oil pooled in those cracks to make him a very rich man. For more than a decade, people in the industry have

excoriated his idea for being too expensive, too technically challenging

and even geologically ridiculous.... Even after the discoveries Trice has made, he’ll need to produce oil

sustainably to truly win over his critics. After his last big find two

geoscience professors from Heriot-Watt University penned a blog post,

outlining all the challenges facing Trice, titled: “Is Britain’s

‘largest oil discovery in decades’ all it’s cracked up to be?” Though

they found the idea “exciting” they pointed out that oil from the sort

of reservoir Trice is targeting has been known to initially surge into a

well, before rapidly petering out. And even if Hurricane can get all

the crude to the surface, some of it may be so viscous and heavy it

becomes uneconomical to produce."

Is a Shale-Sized Oil Boom Hiding in Britain’s Atlantic Bedrock?

Bloomberg, 22 November 2018

"Energy sector analysts are questioning how the US’s show of support for

the kingdom, as it handles its biggest crisis with the west since the

September 11 attacks after the killing of journalist Jamal Khashoggi,

could influence Saudi oil policy....Earlier this year the US called on Opec to unleash more barrels on to

the market to compensate for any losses from Iran as it prepared to

reimpose sanctions on Tehran’s oil industry. Producers led by

Saudi Arabia and Russia relaxed supply curbs and pledged to step up

production, only for the US to issue allowances this month for big

consumers of Iranian oil to buy the country’s crude. This

triggered a fall in crude prices, with rapidly increasing US shale oil

production and concerns about a slowdown in the global economy that

could hit oil demand also weighing on the market. Internationally

traded Brent has tumbled from a four-year high of $86 a barrel in

October to below $64 a barrel, almost wiping out all the gains from this

year. US marker West Texas Intermediate fell from $76 a barrel to below

$55 a barrel over the same period. Producers such as Saudi Arabia

have flagged a potential oversupply and have started talks about new

curbs of at least 1m barrels a day when ministers formally meet in

Vienna next month. Even as some industry observers are wary about

a reversal in strategy, Gary Ross, of oil fund Black Gold, said lower

oil prices would also hit the US energy sector. “It’s not in

Trump’s interest for prices to go down another $10 a barrel, because he

also has to please US shale producers. At the end of the day the Saudis

are going to look to balance the market,” Mr Ross said. US

influence on oil policy comes as Saudi Arabia is also trying to maintain

co-operation with Russia, with which it has developed an oil alliance

since 2016. Crown prince Mohammed bin Salman may meet Russian president

Vladimir Putin on the sidelines of a G20 summit, the Kremlin said."

Trump ramps up pressure on Saudi Arabia to lower oil prices

Financial Times, 21 November 2018

"Canada's oil industry is facing record-low prices for its exports, a glaring lack of infrastructure to bring its product to market, and an uncertain long-term outlook. But

none of that is stopping the oil patch from increasing production. And

as one pipeline project after another fails to launch, the industry is

relying more heavily than ever to ship its oil by rail. According

to Statistics Canada, the volume of oil on Canada's railroads has

soared by 64.6 per cent in just the past year. And in the past seven

years, the number of rail cars carrying oil across Canada has

quadrupled. The spike in oil trains began around 2011, a few years before the July, 2013, disaster in which a 74-car oil train derailed in Lac-Megantic, Que., killing 47 people. Besides the obvious risk to the environment and to human life, there is also the fact that oil producers are crowding out other industries that rely on rail. This

leads to "higher costs and shipping delays for other industries," Bank

of Montreal senior economist Sal Guatieri wrote in a client note

Tuesday."

Canada Is Now A Land Of Oil Trains

HuffPost, 21 November 2018

"The rush to shale has emanated from the rapid evolution and

deployment of fracking and horizontal drilling technologies to extract

petroleum and natural gas from shale rock. Texas and North Dakota have

been at the forefront, with the former now yielding more oil than Iraq,

the world’s fourth largest producer. Looking forward, given that the United States has accounted for 60

percent of new global oil supply since 2008, one of the most pressing

energy concerns remains: how long can the United States continue to

produce increasing amounts of oil? It’s surely a difficult question to answer. The shale bonanza itself

has proven that predicting future energy production is a fickle

business. Back in 2007, for instance, no forecasting body was projecting

how quickly a U.S. shale oil (and natural gas) surge would not just

change the U.S. outlook but also transform energy markets around the

world. Despite using the most advanced forecasting techniques possible,

both the Energy Information Agency’sNational Energy Modeling System and

the International Energy Agency’s World Energy Model were completely

blindsided. So it is clear that nobody can be fully counted on to accurately

predict future U.S. crude oil production. One reason is that the

benefits of higher prices augmented by the non-stop Nadvance of evolving

technologies for production cannot be properly factored into any

forecasting model. After all, these factors are always in flux and

therefore ultimately unknowable."

Why US Oil Production Won't Peak Anytime Soon

Rigzone, 19 November 2018

"Trump says

America needs coal for grid security. The military proves

otherwise. Military bases are using wind, solar and battery storage to

stay resilient in the face of extreme weather or attack...A new report

from the Association of Defense Communities and Converge

Strategies details how military bases are turning to renewables to guard

against blackouts in the wake of floods, storms or cyber attack. “The

[Department of Defense] is deploying these projects because of

increasing threats to the U.S. electric grid,” said Wilson Rickerson, a

principal at Converge Strategies and a co-author of the report.

The report details how adversaries such as China, Russia, Iran, and

North Korea are developing the ability to launch cyberattacks on

critical infrastructure — Russian hackers have already proven capable

for breaking into the power grid. In response, bases are developing

microgrids, installing wind turbines, solar panels, batteries and diesel

generators that can supply power in the event the grid fails."

US Military Bases Using Solar, Wind, & Battery Storage For Energy Security

Clean Technica, 17 November 2018

"On November 19th, President Putin will stand shoulder to shoulder

with President Erdogan during a ceremony to celebrate the completion of

the first string of Turk Stream. The subsea gas pipeline will transfer

15.75 bcm directly from mainland Russia to Turkey. The capacity will

double after the second string is completed. The pipeline will be

operational at the end of 2019. Despite several setbacks, mutual

interests concerning security and trade have ensured the strengthening

of cooperation between Russia and Turkey in the face of opposition from

the West. The first string of Turk Stream, which is almost completed, is

important for bilateral relations. The second string, however, will

service the European market and is a sign of Gazprom’s successful

strategy in the face of opposition from the EU and several European

countries. Rising tensions between Russia and the West after the crisis in Ukraine

and the annexation of Crimea made Moscow reconsider its massive South

Stream project. The pipeline would circumvent Ukraine and transport 63

bcm of natural gas to Europe via Bulgaria. The unbundling legislation

and strong opposition from both Brussels and several European countries

made Gazprom ditch South Stream and opt for a smaller albeit equally

important Turk Stream. The strategy has worked as European companies are

scrambling to participate in the project. Pricing disputes between Russia’s Gazprom and Ukraine’s Naftohaz

Ukrayiny in the 2000s created a need on the Russian side to decrease

transit dependency. After Nord Stream’s success, South Stream would have

connected consumers in southeast Europe directly with Russia’s vast gas

resources. Critics point out that state-controlled Gazprom intends to

increase pressure on Ukraine by depriving it of billions of dollars in

transit fees and weakening its negotiating position. The latter would be

achieved by reducing the country’s transit importance. Moscow, however,

insists that the projects aren’t a malign plan vis-à-vis Ukraine, but

have the goal of improving energy security in the region. While

both the first and second string reduce transit through Ukraine, the

latter is more important for political and symbolic reasons. Gazprom has

yet to decide which direction the second string of Turk Stream will be

heading: north into South Stream’s backyard or west into Greece and

finally Italy. Bulgaria has already increased the capacity of the Trans-Balkan pipeline

to 15.75 bcm in a bid to receive the entire volume of the second

string. Despite Sofia not being the strongest candidate, it makes sense

from a strategic point of view.... Although Turk Stream’s capacity is half compared to South Stream’s, the

pipeline has the potential to significantly impact European markets.

Despite efforts by Brussels to halt Russian projects in Europe, Moscow

seems assured that it will succeed: Nord Stream 2 is already under

construction, Turk Stream’s first string is nearly completed, and the

second one will follow soon. What is striking in the case of the second

string, is the scrambling

by Greek, Bulgarian, and Italian companies and politicians to receive

natural gas from the Turk Stream pipeline. With every passing day it

becomes ever more likely that these pipelines will be completed."

Russia Takes Major Leap In European Gas War

Oilprice.com, 17 November 2018

"... contractors for Gazprom PJSC are building the latest monument to Europe’s growing dependence on Russia for energy: the controversial Nord Stream 2 gas pipeline. Germany could receive more gas pumped directly from Siberian fields as soon as late next year. The

$11 billion pipeline is one of three giant projects helping the world’s

biggest gas producer strengthen its grip on Europe and Asia. Thousands

of miles to the east, the Power of Siberia

pipeline will connect with China, and a project under the Black Sea

will deliver fuel to Turkey and southeast Europe. Russia has sold gas to

Europe since World War II, meeting more than a

third of the Continent’s demand last year. That share could rise to 40

percent by 2025 if increased demand from China and its Asian neighbors,

and higher prices, continue to tempt liquefied natural gas tankers

eastward, says Jonathan Stern, a distinguished research fellow at the

Oxford Institute for Energy Studies. “Expensive energy is back, mainly

driven by China,” says Fatih Birol, executive director of the

International Energy Agency. “We’re seeing record gas imports from

Russia.” The decline of Groningen, the giant Dutch gas field, has also

increased Europe’s import demand. President Donald Trump, keen to sell

natural gas to Europe and capitalize on the U.S. shale boom, has described

Germany as “captive” to Moscow. Last year he signed legislation giving

him the right to sanction companies involved in Nord Stream 2, including

five European partners that are helping fund it. Russian President

Vladimir Putin said on Oct. 3 that the pipeline, whose older sibling

runs roughly along the same route and began delivering fuel in 2011,

would be built even if the other companies pulled out. Nord Stream 2

also has detractors closer to home. Poland, which has a fractured

relationship with its former Soviet ally, nixed the formation of a joint

venture of European energy companies that would work with Gazprom on

the pipeline. The country still buys Russian gas but plans to replace it

with fuel from Norway and other countries when its contract expires by

the end of 2022. The German government and its biggest utilities point

to a commercial

relationship with Russia that’s survived the Cold War as well as

increasing tensions over Ukraine. “They’ve been a reliable supplier for

the last 50 to 60 years,” says Thomas Bareiss, Germany’s state secretary

at the Federal Ministry for Economic Affairs and Energy. “And Russia

needs to talk to the European Union. It keeps us talking.” Russian

natural gas exports to Europe are having another

banner year, after the country shipped a record 6.8 trillion cubic feet

in 2017. But Andree Stracke, chief commercial officer at the trading

unit of German utility RWE AG, isn’t worried by Gazprom’s increasing

hold on the market. “At some point, politicians need to say if they are

concerned, but for us it is business,” he says. “It is a free accessible

market. Whoever wants to sell is welcome to sell their volumes.”

Gazprom

has also had to adjust to how the European market has evolved. Since

gas is now its own traded commodity, its price is less closely linked to

the cost of crude oil and more informed by local natural gas prices.

Demand for gas could soar after Germany shuts down its last

nuclear reactor by 2022 and retires more coal plants, according to Ralf

Bickel, a senior energy adviser at Nord Stream 2. “Having additional

supply from Russia puts Europe in a much more comfortable situation,” he

says."

Russia’s $11 Billion Natural Gas Pipeline Is Primed to Fuel Europe

Bloomberg, 16 November 2018

"Global

oil markets are increasingly over-supplied with light

distillates, such as gasoline, while there are not enough middle

distillates, such as diesel, which has opened a big price differential

between the two fuels. To keep meeting healthy demand for

mid-distillates, refiners are

processing high volumes of crude and creating a glut of gasoline....

Gasoline prices have been hit by a combination of record refinery

processing in the third quarter and flattening consumption from U.S.

motorists which have left the market carrying record stocks for the time

of year. Diesel prices, on the other hand, have been supported

by strong demand from the freight, manufacturing and mining sectors as

well as from oil and gas drillers themselves. Distillate prices

are also being supported by the prospect of even higher consumption from

the start of 2020 when new pollution regulations on bunker fuels used

in the shipping industry come into force. Regulations adopted by

the International Maritime Organization will require shipping firms to

switch from using heavy fuel oil to middle distillates unless they

install expensive scrubbers to clean up their sulfur emissions."

Oil market roiled by too much gasoline, not enough diesel: Kemp

Reuters, 16 November 2016

"IEA said once US tight oil plateaus in the late 2020s and non-OPEC

production falls back, the market becomes increasingly reliant on the

Middle East to balance the market. There is a continued large-scale need

for investment to develop a total of 670 billion bbl of new resources

to 2040, mostly to make up for declines at existing fields rather than

to meet the increase in demand. Meanwhile, with projected demand growth

appearing robust—at least for

the near term—a third straight year in 2017 of low investment in new

conventional projects remains a worrying indicator for the future market

balance, creating a substantial risk of a shortfall of new supply in

the 2020s, IEA said.... IEA’s forecasts an 8 million-b/d rise in US

tight oil output from

2010 to 2025 would match the highest sustained period of oil output

growth by a single country in the history of oil markets. A 630

billion-cu m increase in US shale gas production over the 15 years from

2008 would comfortably exceed the previous record for gas. “Expansion on

this scale is having wide-ranging impacts within North

America, fueling major investments in petrochemicals and other

energy-intensive industries. It is also reordering international trade

flows and challenging incumbent suppliers and business models,” IEA

said. By the mid-2020s, IEA says the US becomes the world’s largest LNG

exporter and a few years later a net exporter of oil—still a major

importer of heavier crudes that suit the configuration of its

refineries, but a larger exporter of light crude and refined products.

Meantime, natural gas becomes the second-largest fuel in the global

mix after oil by 2040, accounting for a quarter of global energy demand

in the NPS. Gas consumption rises 45% to 2040. With more limited room to

expand

in the power sector, industrial gas demand becomes the largest area for

growth. Eighty percent of the projected growth in gas demand is from

developing economies, led by China, India, and other Asian countries.

This reflects the fact that gas looks a good fit for policy priorities

in this region due to widespread concerns over air quality. However, the

competitive landscape is formidable, not just due to

coal but also to renewables, which in some countries become a cheaper

form of new power generation than gas by the mid-2020s, pushing

gas-fired plants towards a balancing rather than a baseload role.... IEA

expects global energy needs to rise more slowly than in the past

but still expand 30% between today and 2040. This is the equivalent of

adding another China and India to today’s global demand. India will

contribute most, almost 30%, to demand growth. India’s

share of global energy use rises to 11% by 2040, though still well below

its 18% share in the anticipated global population."

IEA: Oil demand on a rising trajectory by 2040

Oil and Gas Journal, 16 November 2018

"The International Energy Agency published its World Energy Outlook this week, its annual effort at revising assessments of future demand for and supply of fuels and electricity.

There’s a familiar theme within it: The IEA expects more

renewable-energy use in the future than it did in last year’s outlook,

which was more than it forecast in the 2016 outlook. There’s also

something noteworthy on transportation: The IEA is calling the top on

oil demand from cars. According to the report: Oil

use for cars peaks in the mid-2020s, but petrochemicals, trucks, planes

and ships still keep overall oil demand on a rising trend. Improvements

in fuel efficiency in the conventional car fleet avoid three-times more